- Our Story

- Publications & Resources

- Publications & Resources

- Publications

- IEEE Signal Processing Magazine

- IEEE Journal of Selected Topics in Signal Processing

- IEEE Signal Processing Letters

- IEEE/ACM Transactions on Audio Speech and Language Processing

- IEEE Transactions on Computational Imaging

- IEEE Transactions on Image Processing

- IEEE Transactions on Information Forensics and Security

- IEEE Transactions on Multimedia

- IEEE Transactions on Signal and Information Processing over Networks

- IEEE Transactions on Signal Processing

- IEEE TCI

- IEEE TSIPN

- Data & Challenges

- Submit Manuscript

- Guidelines

- Information for Authors

- Special Issue Deadlines

- Overview Articles

- Top Accessed Articles

- SPS Newsletter

- SigPort

- SPS Resource Center

- Publications Feedback

- Publications FAQ

- Blog

- News

- Dataset Papers

- Conferences & Events

- Community & Involvement

- Professional Development

- For Volunteers

- Information for Authors-OJSP

-

Home

Conferences30 June 2025 to 4 July 2025Conferences Events IEEE JSTSP Article IEEE Signal Processing Magazine IEEE TIFS Article IEEE TMM Article IEEE TSP Article Jobs in Signal Processing Lectures Machine Learning Seasonal Schools Signal Processing News SPM Article SPS Distinguished Lectures SPS Newsletter Article SPS Webinar SPS Webinars SPS Webinar Series Webinar webinars

-

Our Story

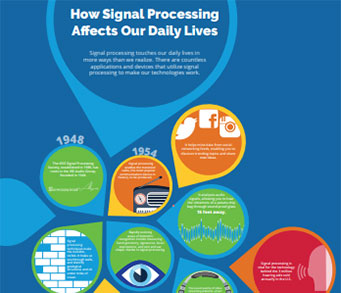

What is Signal Processing?

The technology we use, and even rely on, in our everyday lives –computers, radios, video, cell phones – is enabled by signal processing. Learn More » -

Publications & Resources

-

SPS Resources

- Signal Processing Magazine The premier publication of the society.

- SPS Newsletter Monthly updates in Signal Processing

- SPS Resource Center Online library of tutorials, lectures, and presentations.

- SigPort Online repository for reports, papers, and more.

- SPS Feed The latest news, events, and more from the world of Signal Processing.

-

SPS Resources

-

Conferences & Events

-

Community & Involvement

-

Membership

- Join SPS The IEEE Signal Processing Magazine, Conference, Discounts, Awards, Collaborations, and more!

- Chapter Locator Find your local chapter and connect with fellow industry professionals, academics and students

- Women in Signal Processing Networking and engagement opportunities for women across signal processing disciplines

- Students Scholarships, conference discounts, travel grants, SP Cup, VIP Cup, 5-MICC

- Young Professionals Career development opportunities, networking

- Get Involved

-

Technical Committees

- Applied Signal Processing Systems

- Audio and Acoustic Signal Processing

- Bio Imaging and Signal Processing

- Computational Imaging

- Image Video and Multidimensional Signal Processing

- Information Forensics and Security

- Machine Learning for Signal Processing

- Multimedia Signal Processing

- Sensor Array and Multichannel

- Signal Processing for Communication and Networking

- Signal Processing Theory and Methods

- Speech and Language Processing

- Technical Working Groups

- More TC Resources

-

Membership

-

Professional Development

-

Professional Development

- Mentoring Experiences for Underrepresented Young Researchers (ME-UYR)

- Micro Mentoring Experience Program (MiME)

- Distinguished Lecturer Program

- Distinguished Lecturers

- Distinguished Lecturer Nominations

- Past Lecturers

- Distinguished Industry Speaker Program

- Distinguished Industry Speakers

- Distinguished Industry Speaker Nominations

- Industry Resources

- IEEE Training Materials

- Jobs in Signal Processing: IEEE Job Site

-

Career Resources

- SPS Education Program Educational content in signal processing and related fields.

- Distinguished Lecturer Program Chapters have access to educators and authors in the fields of Signal Processing

- PROGRESS Initiative Promoting diversity in the field of signal processing.

- Job Opportunities Signal Processing and Technical Committee specific job opportunities

- Job Submission Form Employers may submit opportunities in the area of Signal Processing.

-

Professional Development

-

For Volunteers

-

For Board & Committee Members

- Board Agenda/Minutes* Agendas, minutes and supporting documentation for Board and Committee Members

- SPS Directory* Directory of volunteers, society and division directory for Board and Committee Members.

- Membership Development Reports* Insight into the Society’s month-over-month and year-over-year growths and declines for Board and Committee Members

-

For Board & Committee Members

Popular Pages

Today's:

- Submit a Manuscript

- Information for Authors

- SPS Scholarship Program

- IEEE Transactions on Multimedia

- IEEE/ACM Transactions on Audio Speech and Language Processing

- IEEE Transactions on Image Processing

- IEEE Signal Processing Letters

- IEEE Transactions on Information Forensics and Security

- (ISBI 2025) 2025 IEEE International Symposium on Biomedical Imaging

- IEEE Transactions on Signal Processing

- (MLSP 2024) 2024 IEEE International Workshop on Machine Learning for Signal Processing

- Information for Authors-SPL

- Signal Processing 101

- Guidelines

- IEEE Journal of Selected Topics in Signal Processing

All time:

- Information for Authors

- Submit a Manuscript

- IEEE Transactions on Image Processing

- 404 Page

- IEEE/ACM Transactions on Audio Speech and Language Processing

- IEEE Transactions on Information Forensics and Security

- IEEE Transactions on Multimedia

- IEEE Signal Processing Letters

- IEEE Transactions on Signal Processing

- Conferences & Events

- IEEE Journal of Selected Topics in Signal Processing

- Information for Authors-SPL

- Conference Call for Papers

- Signal Processing 101

- IEEE Signal Processing Magazine

Last viewed:

- Submit a Manuscript

- (ISBI 2025) 2025 IEEE International Symposium on Biomedical Imaging

- Information for Authors

- Conferences

- Community & Involvement

- (SLT 2024) 2024 IEEE Spoken Language Technology Workshop

- Society History

- IEEE TMM Special Issue on Large Multi-modal Models for Dynamic Visual Scene Understanding

- Society Liaisons/Representatives

- (ICME 2024) 2024 IEEE International Conference on Multimedia and Expo

- Inside Signal Processing Newsletter

- Signal Processing 101

- Information for Authors-SPL

- Publications FAQ

- IEEE JSTSP Special Issue on Deep Multimodal Speech Enhancement and Separation

Statistical Inference for the Expected Utility Portfolio in High Dimensions

You are here

Transactions on Signal Processing

Publications & Resources

- Publications & Resources

- Publications

- Submit a Manuscript

- Editorial Board Nominations

- Challenges & Data Collections

- Publication Guidelines

- Information for Authors

- Special Issue Deadlines

- Overview Articles

- Top Accessed Articles

- SPS Newsletter

- SigPort

- SPS Resource Center

- Publications Feedback

- Publications FAQ

- Blog

- News

For Authors

Top Reasons to Join SPS Today!

1. IEEE Signal Processing Magazine

2. Signal Processing Digital Library*

3. Inside Signal Processing Newsletter

4. SPS Resource Center

5. Career advancement & recognition

6. Discounts on conferences and publications

7. Professional networking

8. Communities for students, young professionals, and women

9. Volunteer opportunities

10. Coming soon! PDH/CEU credits

Click here to learn more.

Statistical Inference for the Expected Utility Portfolio in High Dimensions

In this paper, using the shrinkage-based approach for portfolio weights and modern results from random matrix theory we construct an effective procedure for testing the efficiency of the expected utility (EU) portfolio and discuss the asymptotic behavior of the proposed test statistic under the high-dimensional asymptotic regime, namely when the number of assets

SPS ON X

- THIS WEEK: Join NASA’s Dr. Jacqueline Le Moigne as she shares her journey through academia, the private sector, and pivotal roles at NASA, emphasizing her work in signal processing, computer vision, and related technologies. Register now! https://x.com/IEEEsps/status/1785057479606288505

- Join NASA’s Dr. Jacqueline Le Moigne for this interactive webinar as she shares her journey through the realms of signal processing, computer vision, and related technologies, including her pivotal roles at NASA. https://x.com/IEEEsps/status/1782468413551423536

- Great crowd at the Student Job Fair at #ICASSP2024! Thank you to our sponsors for furnishing an exciting, engaging event! https://x.com/IEEEsps/status/1780817453569687559

- Thank you to our Women in Signal Processing Luncheon panelists for their wisdom and insights during today’s event at #ICASSP2024! https://x.com/IEEEsps/status/1780458637338530252

- Free Machine Learning (ML) Lecture Series from IEEE SPS From basics to recent advances, unlock the secrets of ML with Prof. Sergios Theodoridis! https://x.com/IEEEsps/status/1779931297093222415

Home | Sitemap | Contact | Accessibility | Nondiscrimination Policy | IEEE Ethics Reporting | IEEE Privacy Policy | Terms | Feedback

© Copyright 2024 IEEE – All rights reserved. Use of this website signifies your agreement to the IEEE Terms and Conditions.

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity.